Personal finance is one of the most intimidating subjects to learn about. There’s a lot of jargon, and everything seems overly complex. Do you initiate an iron condor on the Elliot Wave? Or buy weekly puts with high theta decay? Today’s article throws all this out the window. This is a basic guide to building a simple investment portfolio which generates passive gains.

You don’t have to be Gordon Gecko or Carl Icanh to understand what follows. Additionally, you’ll discover actual funds and assets to invest in.

I always hate abstract advice like “buy an index fund,” so I’m listing specific tickers to get you started.

Do your own research (obviously) and view what I’m writing as “entertainment only,” but the funds listed are some of the most popular and well-regarded in the industry.

Anyway, let’s get started.

Avoid Day Trading And Options Contracts

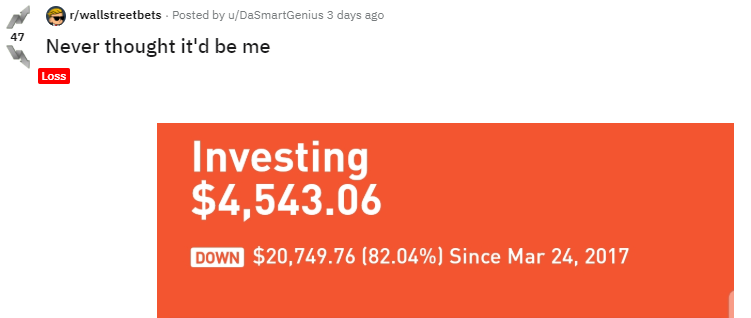

There’s a great forum called Wall Street Bets. It’s all about options contracts and short-term investing.

Sometimes you’ll see threads where a reader turns $50,000 into a million bucks. Or you’ll find screenshots where someone made $17,000 in an afternoon. These are pretty exciting, until you look at the other 99% of posts.

Most users lose money, and it’s common to see new traders down $20,000 – $30,000.

If you want fast money, you’re better off sports betting or playing poker. Both are less technically complex and offer a better rate of return.

For Passive Investing, Go As Broad As Possible

I bought a few shares of Waste Management last spring. They’re currently up 16.04%. That’s an amazing return, until you look at it in an actual dollar amount.

If you invested $10,000 (I didn’t), you’re up $1,600 for the whole year. Not bad, but certainly not enough to live off. Even if you picked 10 stocks and they all generated $1,600 returns, you’re still making less than a Wal-Mart greeter.

Realistically, you’re better off building your active income, while putting surplus cash into an index fund or ETF.

There are a lot of options to choose from, but two of the safest are the Vanguard S&P 500 (VOO) and the Vanguard Total Stock Market (VTI) these track the US economy, keeping you well diversified.

You can can buy these funds through Vanguard themselves, any major brokerage account, or the Robinhood App.

Keep A Cash Reserve To “Time” The Market

On December 24th, the Vanguard High Dividend Yield ETF fell to $73 per share. I bought an extra 50 of them, figuring prices would bounce back.

At the time of writing, each share is worth a tad over $82. That’s a $9 gain per share, meaning I saved $450 by buying the dip.

While it’s fun to pretend you’re a big-baller online, you’re better off saving your money during good times so you can profit during bad ones.

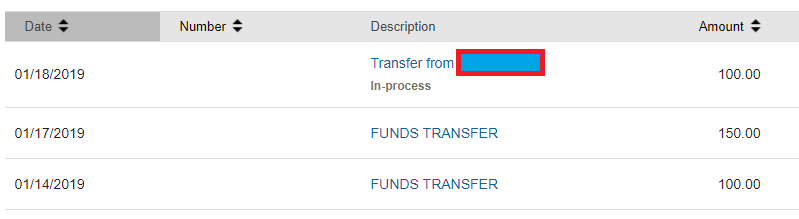

(Using My CIT Account For Extra Cash)

Personally, I try putting $300 – $400 a week into my “opportunity fund.” If you can do more, do more. If you’re on a budget, do whatever amount you’re comfortable with. Either way you’ll build up a pretty good chunk of investable cash.

Then, when an opportunity arises, you can seize it.

Understand The Classic “Lazy Investment Portfolio”

(Jack Bogle Explaining This Strategy In His Guide: The Little Book Of Common Sense Investing)

The “lazy portfolio” is a simple set of three long-term funds meant to perform well during most markets.

The traditional set up goes like this:

- 40% invested in: Vanguard Total Bond (BND).

- 40% invested in: Vanguard Total Stock Market (VTI), or S&P 500 (VOO).

- 20% invested in: Vanguard Total International (VXUS).

This keeps you well diversified and protects you from most risks. It’s also a low-cost portfolio where you aren’t paying insane management fees or constantly churning through stocks.

To quote Jack Bogle (again): “Don’t look for a needle in a haystack. Buy the the haystack.”

My Personal Portfolio

With my current balance, beating the market with a 10% return on investment would yield under $5,000. Not worth it!

Because of this, I keep a very simple investment portfolio that’s pretty similar to the lazy model mentioned above. In 2019, I’m building my account to over 1,000 stock shares total. And here’s what it will look like by the year’s end:

- 33% Vanguard S&P 500 (VOO) – Currently sitting under my target percentage. Mainly because of last year’s wild economy, and the fund’s low dividend payments.

- 33% Vanguard High Dividend Yield (VYM) – Way over the target amount right now as I wanted to build this one up to 330 shares as fast as possible. It’s payouts help fund all the other assets.

- 33% Vanguard Total Bond (BND) – With VYM all built up, this the next big area for improvement. I want to hit 330 shares by summer so the dividend payments can help buy more VOO.

Once this is done, I’ll evenly dollar cost average into the three funds on a monthly basis.

Closing Thoughts

Building an investment portfolio doesn’t require insane financial skills or incredible insights.

If you’re not stock picking or day trading, buy a broad fund and hold it long-term.

You’re getting steady, stable gains without the hassle of trying to predict the performance of single stocks.