In 2018, I sat down at a coffee shop and penciled out a two-year plan. My goal? Build up a quality investment portfolio where the dividends would cover my biggest travel expense: rent. In 2020, I hit this benchmark. Today, I am sharing my thoughts on dividends, travel, and how you can successfully create your own stream of passive income.

We’ll cover how much it costs to live overseas, why dividend income is a good alternative to real estate, and how to invest.

How Much Does It Cost To Live Comfortably In Most Of The World?

I spent much of the year in Chicago. From March until June everything was closed. And from June on there were riots. While Chicago is a nice city, I cannot imagine paying $1,000+ per month to sit inside, twiddling your thumbs while every business is closed and civil unrest brews in the streets. Same goes for New York or any other major American epicenter.

“Price,” as Warren Buffett says, “is what you pay. Value is what you get.” And there are plenty of other areas of the world with much better value.

Here’s my two bedroom apartment in Mexico:

Rent is $550 per month, the WiFi is good, weather’s nice, streets are safe, and there are plenty of bars and restaurants within walking distance. In other words, you are getting a much better value at a far lower price.

Same goes for much of the world.

When I live in Vietnam, I have a housekeeper, go on international vacations every other month, eat out daily, and have a robust social life. It’s rare if I spend $2,000 a single month.

(Here’s What $50 Buys At A Restaurant In Vietnam)

Even with an expensive hobby like sailing, you could still live overseas for much less than what it costs to simply exist in many American cities.

If you’re spending $500 – $800 per month on rent, you need to generate $6,000 – $10,000 per year in dividend income. To collect this much in dividends, you’ll need about $125,000 – $250,000 invested.

That’s a lot of money on paper, but you can reach this investment goal in three years or less. $100,000 broken down over 36 months is about $2,800 per month. Or, about $93 daily. Develop a skill like affiliate marketing, save the extra income, and that alone knocks out a significant chunk of your goal. Even if you are average at sales and copywriting, you can still make $50 – $100 per day on a consistent basis.

Dividends Vs Real Estate

When it comes to passive income, a lot of people really enjoy real estate investing. Buying and renting out houses and apartments is a wealth builder as old as civilization itself. In 16th century Frankfurt, trade fairs would double the city’s population. And during this time, homeowners who rented rooms made more money in a single week than their regular jobs paid all year.

Very traditional route to getting rich. The only downside, is that you’re often tied to a specific location.

There’s nothing wrong with this, but it might be a hindrance if you want to travel a lot or ever feel like packing up to move. Additionally, I have met a lot of people who want to do real estate but simply do not know where to start (or feel very overwhelmed). In many cases these people would be better off sticking to REIT investments where own shares of real estate like it was a stock. Vanguard’s VNQ index and Cohen & Steers RQI fund are both good starting points if you want to research the idea.

How To Maximize Your Investment Returns

- Don’t make investing your only path to wealth. In fact, I would put very little emphasis on this (outside of an IRA or 401k) unless you have a high chance of putting away $100,000 – $250,000 over the next 5 – 10 years.

- You can often “beat the market” by signing up for new credit card offers. The American Express Blue Cash Everyday Card is currently offering $100 back after you spend your first $1,000. And, you get 20% cash back on all Amazon purchases from now until 10/07/2020. Check out this referral link for more information.

- Don’t fall for high dividend yields. Some of companies paying out 4 – 6% are just fine, but many businesses with a high yield are in declining industries or have serious issues. This means you’ll often lose more in capital than what you’re paid.

(Yield Trap Example)

- A boring company you understand beats high flying “lottery ticket” investments. I would much rather own Archer-Daniels-Midland or Johnson & Johnson than gamble on a company like Nikola or Virgin Galactic.

- Growth stocks are fine if you know what you’re doing. I write about my own experiences and that style of investing is outside my circle of competence.

- While there’s nothing wrong with supporting authors, bloggers, and social media accounts that you like, be aware that long-term investing really isn’t that complex. One or two $10 books will teach you more than any $500 investing course. The Future for Investors covers blue chip investing perfectly. And One Up On Wall Street is written by Peter Lynch, one of the best performing stock pickers of all-time. Those two books cover all the fundamentals for long-term investing.

- There’s nothing wrong with buying and holding a low-cost index fund.

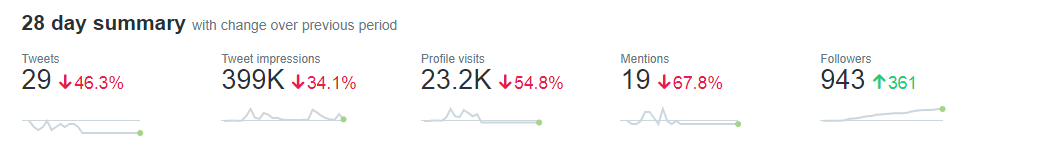

- Building a second income stream is easier than saving your way to wealth. At one point when I was 21, I could have sold this website for tens of thousands of dollars (too bad I didn’t and blogging is dead). Building an intellectual asset (website, eBook, App, link aggregator, etc) is a lot less time consuming than trying to save every penny. I’ve been building some Twitter accounts recently, and it takes me 15 minutes each morning to add an extra 10 followers per day. If this earns an extra $50 per month, it’s the same as collecting a 4% dividend off $15,000.

- Have fun! There’s no sense being a miser. Don’t make money your only interest. Instead, build wealth to support your ideal lifestyle.