A recent study shows 40% of Americans live paycheck to paycheck. Another report claims most citizens have less than $1,000 to their name. This sounds unbelievable, until you look around.

During my recent Christmas vacation to the USA, I was amazed at the sheer number of payday loan centers and pawn shops.

Much of America looks like the bad timeline in Back To The Future Part II.

Rather than complain about it, today’s article offers actual advice on how to stop living paycheck to paycheck. This works whether you’re making minimum wage, or a decent salary. And I’ve included a wide variety of different strategies and techniques.

1. Spend Less Or Make More

The easiest way to stop living paycheck to paycheck, if you have a high-paying job, is to simply spend less.

I have a cousin who racked up $30,000 in credit card debt. He lived at home for the next 12 months, spent as little as possible, and had the whole thing corrected within a year.

Not very fun, but it fixes your finances.

If you have a low-wage job, focus on making more money. If you make $10 an hour, switch to a $13 an hour job. It’s an instant 30% raise. Then get a part-time job too.

The nicest thing about earning very little is that any extra income seems enormous.

I remember doing Fiverr gigs after my regular job and being ecstatic from making an additional $30 or $40.

If you have a career, leverage your skills and expertise into higher paying gigs. A lawyer, for example, could do consulting or set up LLCs as their side-business.

But more on that in a minute…

2. Get A Real Bank Account

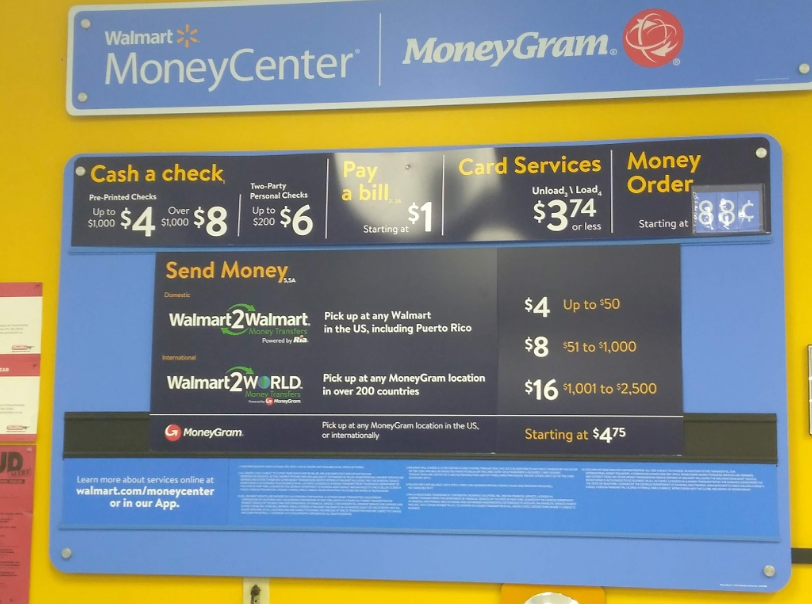

(Don’t Bank Like This!)

Wal-Mart offers one of the biggest check cashing services in America. This shocks me. Especially since the store charges users a fee.

You pay $4 for for any check up to $1,000, and $8 for anything over that. If you’re making $10 an hour, you’re spending 1% of your income on check cashing services.

That’s insane!

Most local banks aren’t much better, with their annual service fees and low-interest rates.

In fact, the average bank offers a measly .1% annual interest on savings accounts.

Don’t settle for this and open a high yield savings account instead. I have two of these (one with Ally, one with CIT) and they’re both great.

Ally Bank (no affiliate) offers 2% annual interest, and CIT now offers 2.49% returns.

That’s considerably better than what most places offer.

Also, since there’s always some controversy about the “best savings account,” here’s a video covering several options:

Having a high yield savings account is the closest thing to a guaranteed return on investment. It’s also a great way to build up your emergency fund.

3. Read These Two Books (They’re Free)

There are a ton of personal finance and business books. Most of them are overly complicated, or not applicable unless you’re already a high earner.

If you’re making $10 – $12 an hour, it would take years of savings to even reach the minimum deposit requirements for many big index and mutual funds. Likewise, reading an Elon Musk biography probably won’t help you much.

Instead, I’m going to recommend two practical books with a lot of easy to follow advice.

Number one is The Richest Man In Babylon. You can buy it for under $10 on Amazon, or listen to it for free on YouTube:

The second book is Letters From A Self-Made Merchant To His Son. Another book for under $10 on Amazon, but also free on YouTube:

These two titles cover all the basics of personal finance, debt management, and building wealth. Read them, follow their advice, and you won’t have to worry about living paycheck to paycheck again.

4. Start A Service Business

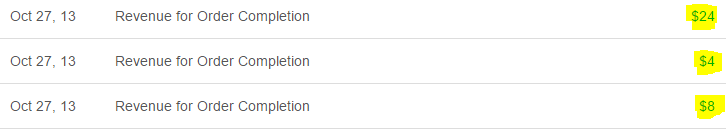

(Old Screenshot From Freelancing On Fiverr)

Passive income is great and I love picking up zero-effort royalty checks. However, it takes a lot of work get these results.

It’s tough to recommend creating information products unless you’re already an expert on something or have superhuman levels of self-discipline (writing takes time).

Most people are better off starting a service business instead.

This require a lot less work upfront, have a lower barrier of entry, and are fairly straightforward. You perform a task, then get paid.

These jobs can range from blue-collar activities like lawn service, to high-end ventures like consulting. Personally, I used to do freelance writing. But there are a ton of other options as well. Think about your personal skill sets, figure out which of them you can monetize, and then create a service business around this.

Even if your service business never takes off beyond a few weekend gigs here or there, it’s still going to help you break the cycle of living paycheck to paycheck. You’ll have some business contacts, plus an understanding of how to make money independently.

When there’s a government shut down or corporate layoff, you can always use your side-business to stay afloat.

5. Reframe Status (The Easiest Way To Stop Living Paycheck To Paycheck)

What is “cool?”

When I was 17, there was a whole group of slightly older guys who didn’t go to college. Instead, they got low-effort minimum wage jobs, rented a sh*tty ranch house, and threw crazy parties every weekend.

As a teenager, that’s a cool lifestyle.

At 25, that’s embarrassing.

What’s cool is always subjective.

This goes for lifestyles as well as fashion and social trends.

In 2013 I made $10 an hour, I also bought more consumer goods than I have in any other year.

In 2018, all these purchases are complete junk with zero value.

Consumer goods are depreciating assets. Likewise, popular brands are often the most mediocre. $160 Airpods are a big status symbol right now. Yet you can buy regular earbuds with better sound quality for $20.

Buy higher-quality but lesser know brands, then invest the difference into yourself.

If you’re working a low-wage job, use that money towards starting a business or creating active income.

If you’re middle or upper-middle class, do the same thing. Or, buy revenue producing assets.

I live near a big luxury mall and it’s amazing to see the number of guys who rush out and blow their entire Christmas bonus on depreciating assets. If you have enough disposable income to buy a new car or high-end watch, you also have enough to make a substantial investment generating long-term wealth.

Or, as Dave Ramsey famously put it: “Live like no one else now so later you can live like no one else.”

Closing Thoughts

Your choices compound over time and seemingly insignificant decisions can have a huge impact on your future.

This is why it’s important to develop good habits. Especially with money.

At 19, I saved up $4,000 over the course of an entire year. That’s not some huge amount, but it taught the importance of living below your means and having self-discipline.

Mastering your money is crucial, no matter how much you make. So you might as well start now.