In 2010, Roscoe Dash had hit singles playing on radio stations across the country. The money rolled in and there was no end in sight.

In 2010, Roscoe Dash had hit singles playing on radio stations across the country. The money rolled in and there was no end in sight.

Now he drives a Lyft.

For years my Dad owned a construction company, before getting out in 2007. If you’re unfamiliar, real estate development attracts many “fake it ’till you make it” types. Guys wearing four Rolexes on the same arm, or driving a different color Ferrari to work each day.

They made good money (or at least enough for leverage) during boom times. But assumed the bubble wouldn’t burst.

Any economic downturn left them hanging from the rafters or in serious trouble (my Dad tells a funny story about some developer who couldn’t pay a Tony Soprano type contractor, and ended up hiding in his office bathroom to avoid confrontation).

On a more personal note, my distant aunt and uncle are two smart people making about half a million dollars per year (he does computer stuff, she’s a surgeon). Apparently they didn’t save any money for retirement (instead making impulse buys, like a $30,000 pizza oven they’ve never used) and are now in a very stressful situation.

Today’s article is all about avoiding this mistake. We’ll look at ways to reinvest your money, making your assets work for you.

These are all things I do, so it’s not a complete list of all available investment options. Also, quick side note, I’m obviously not a financial adviser. So do your own research first.

Anyway, with that out of the way, let’s dig in.

Low-Risk Dividend ETFs

I don’t day trade or try to “beat the markets.” Most people attempting this fail, and (unless you’re playing with millions) it seems like a giant waste of time.

Buying $10,000 worth of FitBit stock, then selling it once the price rises $0.01 is too much risk.

Same goes for single stock swing trades.

“Market gurus,” like Jim Cramer, fail to keep pace with the S&P 500. And their strategies involve tireless research, corporate evaluation, and a whole bunch of complex metrics for picking individual stocks.

Instead, I just buy ETFs. These are index funds which trade like stocks, and they contain a whole bundle of assets.

Like any asset, some ETFs are great while others are trash.

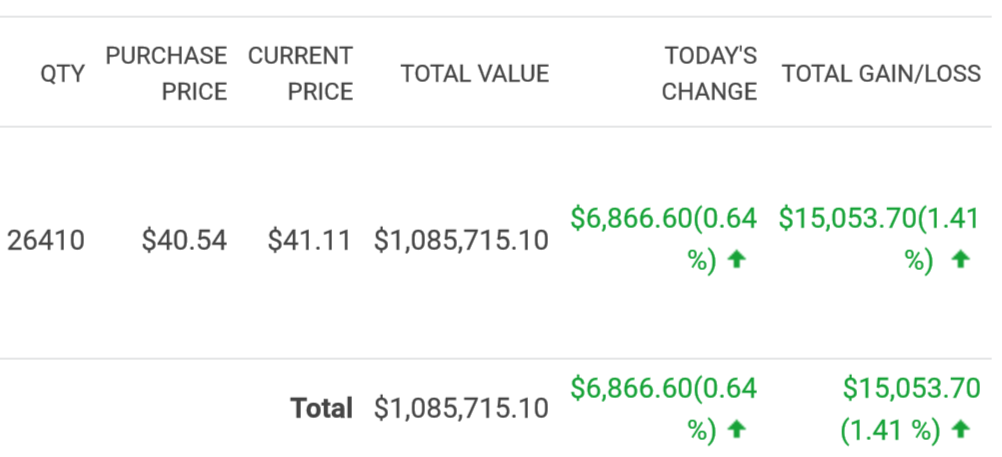

My two biggest holdings are VOO (Vanguard’s fund mirroring the S&P 500), and VYM (Vanguard’s high dividend fund). I also own a few smaller holdings too, like SPHD which pays a monthly dividend.

(Investopedia Monthly Dividend Model Portfolio)

These “strays” are more for experimentation, in my model portfolio SPHD generates $3k+ per month in dividends, and fun. Also, I do own a handful of single stocks. These are mostly dividend aristocrats, and I bought them to practice asset research.

But, for the most part, Vanguard ETFs are my biggest holdings.

With VOO you’re getting the entire market, something Warren Buffett advocates. And, your management fees are incredibly low. I think Vanguard charges about $8 per $10,000 (annually), and it’s even lower if you buy directly into their Admiral Shares program.

Lastly, all these pay a dividend. So you’re getting paid just for holding the asset. VOO’s rate is about 1.9%, so you’re getting $190 per $10,000. And VYM is 3%, giving you $300 per $10,000.

That’s not huge money, but it adds up over time. Plus, you’re still making something even in a sideways or stagnate market. If you have excess money you aren’t going to spend, parking it in ETFs is something to consider.

High-Risk Speculation

In 1980-something, my parents took a trip to New York. While there, they spent $500 on a painting by a little-known artist named Keith Haring.

In terms of appreciation, that painting has beaten the S&P 500 many times over.

At the time, however, my parents didn’t know this. They thought the design looked cool and it might have some value in the future. In financial terms, this is called speculation. You buy something with no guarantee of it holding or increasing value (many obscure artists stay obscure). But, if the value does go up, you’ll often see considerable gains.

Some examples?

- Family heirlooms (think Antiques Roadshow).

- Buying $100 worth of BitCoin in 2009.

- Real estate that’s off the beaten path.

- Investing in long-shot stocks.

- Purchasing art.

I don’t put a whole lot of money into these, because they are high-risk and unpredictable.

However, I will throw a couple hundred bucks into some high-risk assets. I own BitCoin and several alt coins, plus I have an annual fixed-fund for placing sports bets / playing poker.

This is more of “fun money” than anything else. Because, if I don’t see a good speculative play, I don’t invest.

When BitCoin hit the $9,000 range, I didn’t buy any more. And I haven’t placed any bets in over five months. Instead, that money gets held in cash.

Picking a winning altcoin or throwing cash onto a prediction is kind of like playing video games. It’s exciting and fun, but I certainly wouldn’t use it as a long-term investment strategy. To paraphrase Warren Buffett’s thoughts on gold: When BitCoin was $20,000 a piece, you could have bought 80 shares of the S&P 500. You’re owning a slice of every major corporation, and are backed by 100+ years of aggregate growth.

Which is more likely to fall in value?

Regular Cash

Years ago I read Tony Robbins’ Money: Master The Game. At on point, there’s an interview with Marc Faber. He’s a billionaire investor and always buys when there’s “blood in the streets.”

In the book, Faber shares his number one piece of investment advice:

You have to keep cool and have money when your neighbors and everyone else is depressed. You don’t want to have money when everyone else has money, because then everyone else competes for the same assets, and they are expensive.

Basically, don’t invest during an all-time high or mania.

When everyone else decides something is “going to the moon” (be it $20,000 BitCoin or rapid growth Chinese meme stocks), don’t join in. Instead, as Marc Faber says, just wait for the price to fall.

Case in point, between June 5th and June 16th, all my choice investments were up. Since the S&P 500 (historically) grows by a mere 1% during summer months, I figured there’d be a slump.

That investment money stayed in cash.

Then, the trade war started two weeks later.

Once everything fell, I started buying. And, as of writing, these assets are on the rebound and appreciating in value.

While savings accounts give terrible returns, there’s nothing wrong with sitting on cash. It gives you the power to take advantage of future opportunities.