In 2017 BitCoin died.

In 2017 BitCoin died.

In one day the value plummeted from its all-time high of $4,000 to just $3,000. When this happened, I tried “buying the dip” and invested $250.

The price recovered within 24 hours. Three months later, a new all-time high was established at $11,000. My $250 experiment yielded almost 400% in returns.

Since then, I’ve capitalized on every crypto crash. Buying up BitCoin when it “dies,” and selling it off once the markets bounce back. It’s the oldest investment trick in the book, and surprisingly effective.

This article examines how the strategy works, when to use it, and what to invest in.

By the time you finish reading, you’ll have a basic understanding of how to capitalize off crypto crashes.

Why Buy Dips?

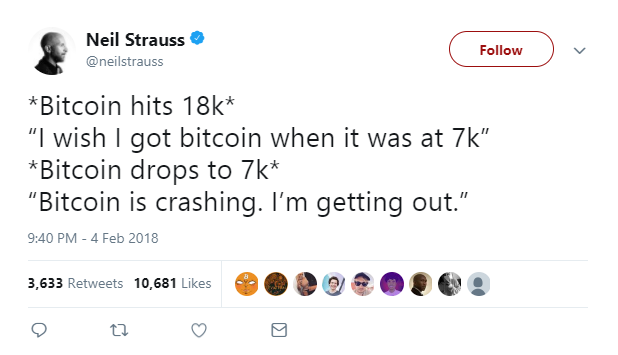

People are panickers.

If you do any copywriting or sales, you’ve probably realized that the average person has no backbone. The idea of taking a risk or losing money terrifies them.

This is why sales letters always include a phrase like “guaranteed to work,” or “the foolproof system that always turns a profit.” Most people simply cannot stomach risk. And when bad things happen, they freak out.

Once you know this, it’s easy to take advantage.

(Everyone Wants The Rewards, Most Can’t Handle The Risk)

As Warren Buffett says: “You pay a very high price in the stock market for a cheery consensus.” But when things are bad, you get a huge discount on valuable assets.

The last crypto dip (for example), dropped BitCoin from $11,000 down to the $6,000 range.

A few weeks later, prices climbed back up to $11,660. If you bought anywhere below $9,000, you got 20% – 50% returns.

Not bad.

Buying during bad times is an excellent way to increase your maximize your buying power. And, in many cases, doing so instantly turns a profit as soon as the market recovers

Spotting A BitCoin Dip And Timing Your Purchase

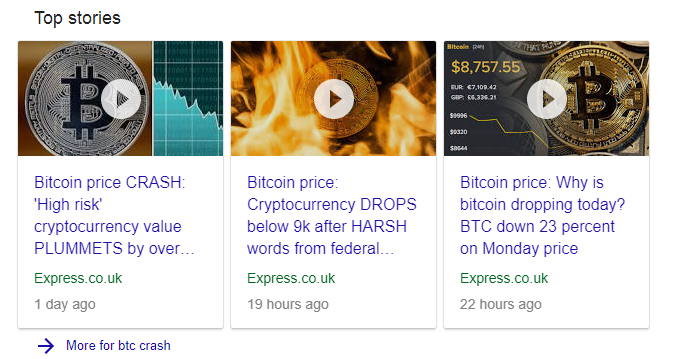

(When Your News-Feed Looks Like This, Invest)

This will sound laughably stupid, but here’s my strategy for forecasting crashes:

- Google “BitCoin,” “BTC,” or “BTC to USD.”

- Look at the trending news stories.

- If every article is doom and gloom, start monitoring the charts and get ready to buy.

It’s embarrassingly simple, but works.

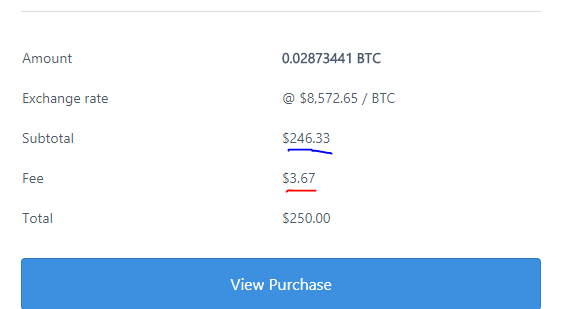

Case in point, yesterday’s “crash.” I waited until every network ran a “Death Of Crypto” article. Then I bought in once BitCoin dropped to $8,572.

One day later and it’s back up to almost $9,300.

That’s roughly an 8% return on investment.

Additional Resources

Obviously the system I explained is very basic. And when it comes to crypto I’m certainly no expert. Because of this, I’d suggest doing your own independent research too.

The book Triangle Investing (no affiliate link) does an excellent job explaining how different coins work, why certain ones increase in value, and how to invest in a variety of cryptos like BitCoin or Etherium.

I really enjoyed this title and got tons of value from it (it’s like $9 and more in-depth a million times than those “Crypto Masterclasses” you see advertised on YouTube). Well worth a read!

Another good book is Cryptoassets. It explains how to invest, what to buy into, and provides information on avoiding coin manias and other bubbles.

There’s also a good write-up on BitCoin exchanges, wallets, and all the other technical details needed for investing.

Very comprehensive.

Lastly, if you’ve never purchased BitCoin before, I’d recommend using CoinBase when starting out. Some might disagree, but I think it’s a good starting point.

They’re the biggest (and most popular) crypto exchange in the world. Plus, they’ve got a relatively low transaction fee of $3.67 per $250 invested. (Hot tip: deposit funds with your bank account, not a debit or credit card. It’s cheaper than way).

(Here’s My Last CoinBase Receipt)

If you sign up through this link, CoinBase also give you $10 in free BitCoin after your first $100 deposit.

That alone offsets any transaction fees.

Closing Thoughts

Capitalizing off BitCoin dips is a smart investment strategy.

While most people “buy high and sell low,” you’re taking advantage of market chaos to turn a profit.

Monitoring the news and watching for doomsday predictions lets you snag cryptos at a discounted rate. Once the panic blows over and markets rebound, you’re getting a fairly significant return on investment.

P.S. Use some common sense when playing the dips. Don’t go all-in if the price falls by $100 or something like that. Instead wait until it’s down considerably.