Warren Buffett is the Kim Kardashian of investing. You can’t open a financial webpage or flip on a CNBC program without seeing some expert suckling on Buff-Daddy’s big creamy Dilly Bar.

The man is so synonymous with stocks that if you asked the average investor for a hot tip, they tell you to “invest like Warren Buffett.”

Often, they’ll recommend copying Buffett’s exact portfolio. So that you’re only holding the same stocks as Berkshire Hathaway.

Today’s article examines why this isn’t always a great idea.

But, before we get into things I do have a disclaimer to make. This article is not about Buffett’s investment principles, or value investing itself. It’s about the dangers of turning yourself into a Warren Buffett cosplayer, copying his exact moves without understanding why he’s made them.

With that out of the way, let’s look at some behind the scenes tactics that have made Buffett so successful. And why the average investor cannot replicate them.

Warren Buffett Is A Businessman First And An Investor Second

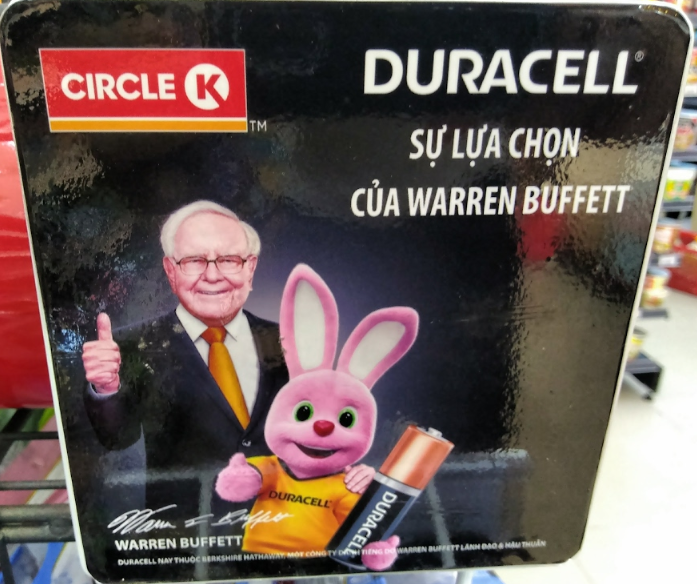

Over the summer I walked into a Circle K convenience store. Right next to the counter was a big smiling Buffett, accompanied by the Duracell Bunny.

Wondering about their relation, I went home to do research.

Here’s the story:

Berkshire Hathaway wanted to buy Duracell from its parent company (Proctor & Gamble).

Rather than pay money for the business, Buffett simply traded his Proctor & Gamble shares back to the company. Proctor & Gamble gained more control of their own stock, and Buffett got a whole new business.

Warren Buffett is a shrewd negotiator and businessman who also happens to own stocks.

As you’ll see in a moment, a lot of his money is the result of owning whole businesses, not from merely investing in blue chip companies.

If You Want To Invest Like Warren Buffett, Just Buy Berkshire Stock

Warren Buffett’s financial success comes from owning a plethora of other businesses.

Here are a few companies that Buffett and Berkshire Hathaway own outright:

- GEICO

- NetJets

- Acme Brick

- See’s Candy

- Dairy Queen

- Pampered Chef

- Fruit Of The Loom

- Oriental Trading Company

- Burlington Northern Santa Fe

So while Warren Buffett does make money off his Coca-Cola and Wells Fargo stocks, he’s also running a huge conglomerate. One which profits off everything from underpants and choo-choo trains to private jets and construction materials.

If you’re interested in making money like Warren Buffett, you might want to buy stock in Berkshire Hathaway itself, instead of trying to mirror his investment portfolio.

Money Begets Money (In Ways You Can’t Replicate)

When Warren Buffett invests, he’s putting down so much capital that companies will actually give him special deals.

For instance, Buffett’s GE preferred stock gave him a guaranteed 10% annual dividend payment. Unless you’re a billionaire you’re not getting any guaranteed return on investment.

Lifetime Holdings Depend On The Era You Were Born

If you bought Bethlehem Steel stock in 1910, you could hold onto it for 50 years without much worry. Purchase those same stocks in 1990 and they’d become worthless within 10 years.

While many of Buffett’s holdings are classic blue chip stocks like Coca-Cola, I have a feeling that a few of the assets are in for a rough future. United Parcel Service (UPS), for example, will take a huge hit if/when Amazon creates their own delivery service.

Likewise, some of Buffett’s older holdings, like GE and IBM, haven’t aged well. Buffett has dumped both stocks recently, however this doesn’t help late-stage investors who jumped on a sinking ship because “the Oracle Of Omaha owns it.”

Blindly buying an asset because someone successful has it is never a smart idea.

Warren Buffett Invests In What He Knows

It’s always important to understand what you’re buying. And Warren Buffett admits that he really doesn’t know much about tech stocks or Internet companies.

Likewise, he doesn’t invest in gold, commodities, or BitCoin.

As such, if you only listen to Warren Buffett, you’re going to miss out on some great opportunities.

Final Thoughts

I love Warren Buffett and think he’s a terrific businessman with some incredible insights. However, I also think that his ability to explain investment concepts in a simple, easy to understand manner accidentally confuses a lot of people.

Many investors know that Warren Buffett owns stocks, but they never look at the rest of his ventures.

As such, they rush out to buy “surefire assets” like Wells Fargo (up 8% over the past five years) or UPS (up 16% in over the past five years).

The point of this article isn’t to say Warren Buffett sucks at investing (he doesn’t) or that he picks bad stocks. It’s about making your own informed decisions. Copying anyone (whether it’s a YouTube day trader or the Buff-Daddy himself) often puts you at a disadvantage because you don’t have a deeper understanding of why you’re doing something.

If you want to invest your money (in stocks, BitCoin, a dropshipping store, etc) make sure you understand the fundamentals first.