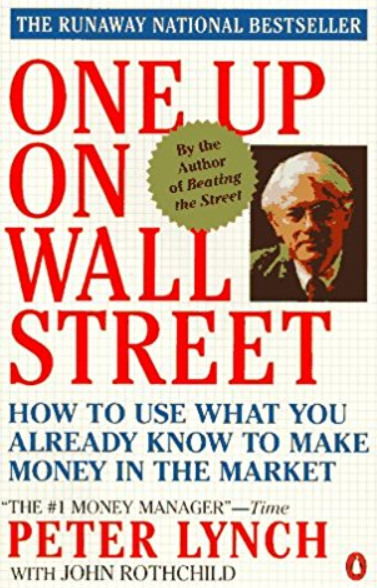

One Up On Wall Street, by Peter Lynch and John Rothschild, is a terrific book on stocks. It’s fun, informative, and walks you through the entire process of picking winning investments.

One Up On Wall Street, by Peter Lynch and John Rothschild, is a terrific book on stocks. It’s fun, informative, and walks you through the entire process of picking winning investments.

The authors start off slowly, gradually introducing new market concepts and strategies in each section.

By the end of the book: you’re able to analyze opportunities like an investor, understand a company’s balance sheet, use price / earnings ratio to avoid overpaying, and discover any “hidden assets.” which might increase the value of your stocks.

Since some of these topics are beyond the scope of one article (and many of the ideas build upon one another), I thought I’d share two of the book’s best lessons you can implement right away.

Here they are.

How To Select Winning Stocks (And Avoid Bad Ones)

One Up On Wall Street gives the advice to “invest in what you know.” According to Lynch, many people feel insecure when investing. They aren’t sure what they’re supposed to do, so they try to compensate by putting money into the most “respectable” and “prestigious” stocks available.

This is like playing poker without ever looking at your cards.

Instead, Lynch recommends using your own personal experiences as the basis for investing.

If you’re a doctor, for instance, and you notice certain pharmaceuticals surging in popularity, it’s a good idea to look into who manufactures these drugs and whether or not they’re a public company.

Similarly, a construction worker can observe that there’s a building boom, then invest in businesses that produce construction supplies.

This principle applies to every industry, as well as consumer goods.

Looking at what’s popular or on the rise gives you a good clue as to which industries are profitable. And, it helps you sniff out growing companies that’ll soon offer massive returns.

Personally, I know several people who’ve successfully used this tactic.

When my Dad was in architecture school, he invested Xerox and the earnings helped cover the down payment on his first rental property.

More recently (2011 or so), a friend’s dad observed that “all the kids are watching more Netflix than cable,” and promptly bought their shares. He’s easily made 100 times what he invested.

Lastly, while One Up On Wall Street does suggest to invest in what you know (or what you see rising in popularity), Lynch advises to stay away from anything that gets too big too fast or becomes a mainstream sensation.

I’ll explain.

Stocks To Skip

Here’s one of the big lessons from One Up On Wall Street: Avoid tech companies, hot trends, and businesses promising to “revolutionize” their industry.

Why?

Most of this companies experience fleeting success, at best.

Once they start gaining traction, a million competitors flock in to knock them off. Uber became popular, so now there’s Lyft, Hailo, Grab, Didi, and a bunch of other imitators.

In some of these cases (like Grab in Southeast Asia, or Didi in China), the knock-off is actually more popular than the original. Because tech is easily replicable, there’s nothing stopping competitors from making their own variations of a profitable idea.

Additionally, technological innovations move at a breakneck speed. In 2005 everyone had a portable DVD player. By 2009, that industry was obsolete.

Instead of going all-in on the latest tech craze, Lynch suggests looking for companies which niches where competition is all but impossible. If a business can’t be beaten physically (gravel pits), logistically (hotel chain with 100,000 locations), or legally (pharmaceutical patent), you’ve got an edge.

How To Tell If A Stock Is Overvalued

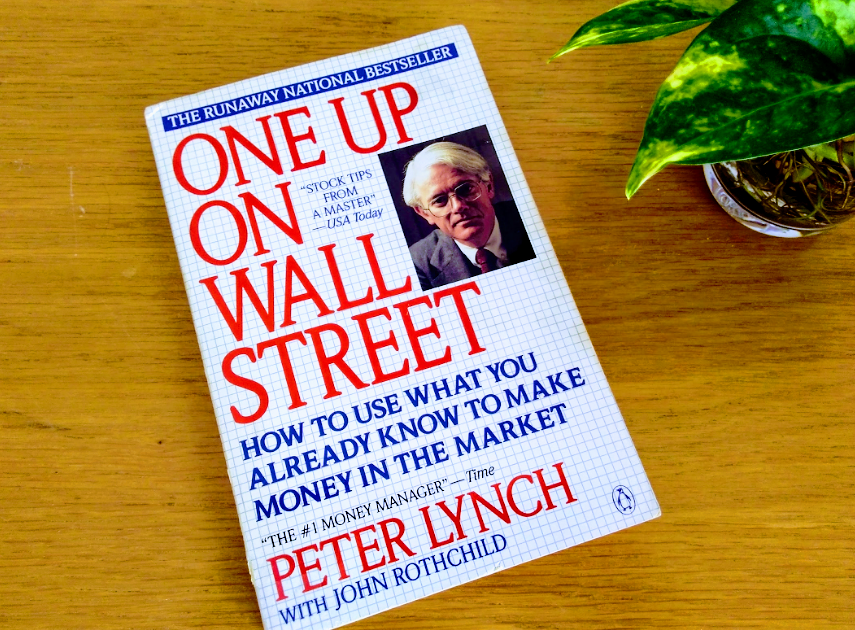

A stocks price / earnings ratio (P/E) shows you how many years it’ll take a company to recuperate your initial investment.

Some businesses have a low P/E (Ford’s is currently just under 6 years) while others are absurdly high. When a company’s ratio gets too big, it’s a sure sign that the stock is over-valued.

Case in point, Netflix.

Last year, Netflix stock doubled. Each share rose by $150, making it a hot commodity. Because everyone wants it, the goes up further.

Right now Netflix (on paper) is valuable.

However the P/E ratio is insanely high, sitting at 228. If Netflix continues to earn at its current rate, you’ll recoup your money two and a half centuries from now.

(Netflix P/E Ratio)

In One Up On Wall Street, Lynch explains that when the majority of stocks have abnormally high P/E ratios, it’s a sure sign that the market is due for a correction. Prices will drop, and bloated assets revert back to their real-world values.

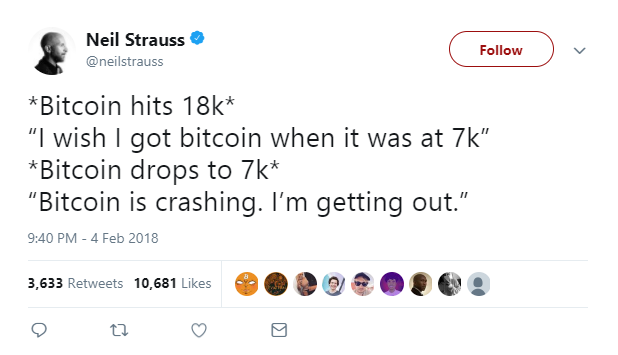

When this happens, people who bought at the peak are victims of “buy high and sell low.”

Meanwhile, smart investors can take advantage of the situation and purchase high-quality assets at a reasonable price.

One Up On Wall Street: Final Thoughts

This is a great book that explains how to understand various aspects of the stock market, how analysts select assets, and how to find valuable opportunities with potential for massive growth.

If you have any interest in stocks or investing, One Up On Wall Street is a fascinating read.

Click Here To Order Off Amazon

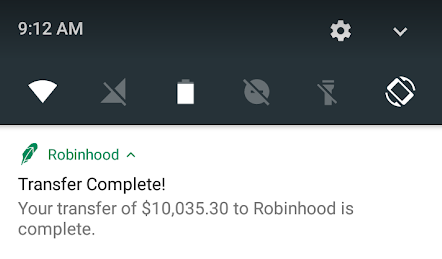

P.S. If you’re looking for more investment related content, check out my Robinhood App review. It’s a fantastic service for buying stocks without having to pay a brokerage fee.

If you want to invest in the stock market, then you need to check out the Robinhood App.

If you want to invest in the stock market, then you need to check out the Robinhood App.

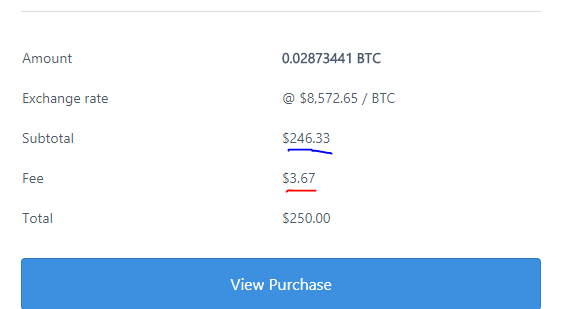

In 2017 BitCoin died.

In 2017 BitCoin died.