“I would not pre-pay. I would invest instead and let the investments cover it.”

– Dave Ramsey

Turn $20 into $20,000 (A guide to investing in yourself)

Last week I was going to buy almost $500 worth of camera and lighting equipment. A professional green screen, high quality lights, a special microphone, and tons of other really expensive stuff.

Then I sat down and did the math. $500 worth of camera equipment isn’t a good investment for a project (my YouTube channel) that hasn’t even earned a cent. It’d be an uphill battle from the start.

I’d need to monetize all my videos right away, recommend products, and work to recover my money.

The project would start out as a loss. If I got bored, or nobody watched my videos, I’d be out.

I scrapped my big budget. On Wednesday my $10 camera stand arrives. That and a few thrift store paintings are my only investments. If things go well I can scale up. If the project flops I’m out nothing.

How to invest in a project

When I started my professional writing career there were all kinds of people trying to offer $300 workshops and seminars. They all claimed that “you’d never make it” without one.

I was making $10 an hour and didn’t have $300 to blow.

Instead I looked around at easy freelancing gigs and copied the people who were successful. That was enough to get me started.

In the beginning you should never invest in anything extra.

Hands-on learning will never cost you

My first business folded after six months. It had grown so fast that I couldn’t keep up anymore.

When I shut the doors I actually came out ahead. I’d learned how to make money, market a service, and run a company. Plus I was getting paid to do all of it. My entire education was subsidized.

A weekend writing course would have cost a lot of money with very little practical return. Meanwhile, I was getting the same information as I made money.

Paying for seminars and classes doesn’t guarantee anything. Jumping into the fray and testing things out on your own will teach you far more. Practical knowledge always trumps conference room speeches.

The difference between a wise investment and frivolous spending

Before someone nitpicks or says “you have to spend money to make money,” I want to clarify my point. Spending money should be something you hold off on until you start to succeed.

Launching a $10,000 advertisement campaign for a product making you $30,000 is a lot different than betting $10,000 on a product that hasn’t earned anything.

Spending money without any evidence of a return is never a smart idea.

Going into debt for a business is even worse.

There are obviously some exceptions to this, like designing high-tech medical equipment or developing a new gadget, but 90% of businesses don’t require anything fancy.

Unless you’re trying to create a fusion engine or design the next major communication platform you can get by with a tiny investment. Usually less than $500.

Two real life examples of good investments

Bold and Determined is a website that makes tens of thousands of dollars every single month. Its owner, Victor Pride, has never spent a penny on advertising or hired an SEO firm. He built an entire empire from scratch.

If Victor had hired marketing teams and social media consultants he probably wouldn’t be as big as he is today. Those groups chase after what’s trendy. They’ll never carve out their own niche and build something with longevity.

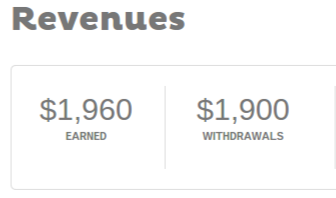

As I mentioned before, my first writing business cost me absolutely nothing. I made $2,000 in my second month of business and the profits went straight into my pocket. Had I gone to writing seminars and hired an adviser I’d be broke.

Since then I’ve launched a lot of different ventures and none of them have ever cost me more than a couple bucks. If they all failed tomorrow I really wouldn’t be out much.

Try and start every single business with a budget of $100. This might sound tough when you’re getting on your feet, but you’d be surprised at how little starting a company actually costs.

Closing thoughts

Don’t spend money unless you know that you’ll make it back. Gambling thousands of dollars on “a good idea” is about as smart as flying to Vegas and betting your life savings on roulette.

Unless you really know what you’re doing taking a huge risk is never a good idea. Try to make smart moves that allow you to continuously expand.

Steady growth might not sound exciting, but you won’t go broke from it. Take advantage of opportunities that you can easily capitalize off of.

Don’t leave your entire future to chance.

You can always grow and acquire better stuff. Let your earnings cover new expenses. Don’t dip into your own pocket to finance unreliable endeavors.