It’s almost Christmas, which means shopping season. There’s a good chance you’ll be out buying gifts within the next few weeks, and one of those presents might even be for yourself. The holidays are also a time when many people blow their financial load on high-ticket items, either for themselves or for family. Because of this, I thought it would be fun to look at how you can buy expensive things in a smart, reasonable manner.

Today’s article looks at whether or not it’s worth making expensive purchases. And we’ll examine superior (and more rewarding) alternatives.

Ready?

1. Is Your Brag Worth The Price Tag?

As someone who grew up in the Midwest, I’m always amazed at the number of friends and relatives who move to a coastal city specifically to brag. They aren’t headed to Wall Street or working in the film industry, instead they’re doing menial tasks or have a low paying desk job which could be done anywhere in the country.

Seriously, I know people who live in LA or NYC on less than $60,000 (pre-tax) and destroy their financial futures in exchange for taking Instagram pics or flexing on cousin Dale about “authentic pizza” come Thanksgiving.

The same goes for material purchases.

Most designer clothes are not made for rich people. If you live in a major city (especially one with lots of international tourists) go look at the people shopping at Gucci. They’re not exactly high-brow, sophisticated consumers. Same goes with cars. There are a lot of bus boys or retail workers driving expensive vehicles.

Even high-income earners fall into this trap with endless home renovations, or buying the most expensive house they can finance.

Is it really worth taking out a loan to buy a depreciating asset that’s going to go out of style within the next five years?

2. If You Can Buy It, It Isn’t Status

This ties into the first point. namely, most status symbols are made for middle-class people. A Rolex Submariner or BMW 2-Series isn’t made for some ultra exclusive billionaire. And the fact that you know co-workers or neighbors who own these things is a dead giveaway.

A lot of materialistic status symbols are easily obtainable if you save up a few bucks. You can buy expensive things like watch or new set of golf clubs from doing an extra hour or two of work on the side. Any college student can buy a Rolex if they’re willing to mow lawns or shovel snow after class. True status symbols (or brag worthy accomplishments) are things you can’t buy. Here’s a few examples:

- Being in great shape.

- Not having to work for money.

- Mastering a skill like piano or violin.

- Having leadership status among peers.

- Social and political connections to people with real power.

Being able to take an impulse ski trip or having a great physique is way more impressive than driving a slightly above average car.

3. How To Buy Expensive Things Like The 1%

If you aren’t a high-income earner, don’t even consider buying expensive stuff. Putting the bulk of your net worth into a depreciating asset is stupid.

By the same token, if you are making good money, look to invest like the wealthy. Buy assets first, and let those cover your hobbies. Putting your bonus or record sales month into real estate or stocks doesn’t sound exciting, but do that for a few years and you use the gains to buy whatever expensive things you’d like.

One of the reasons that wealth inequality is a recurring issue throughout history is due to a very simple formula. If you only remember one thing from this article, remember this:

r > g

This is a finding from French economist Thomas Piketty, about why the middle-class is (historically speaking) a fluke of nature. What this formula means is that capital returns (r) outpace economic growth (g). In other words, you make a lot more money owning revenue producing assets than you do working a job.

This is the reason that centuries of aristocracy spend their time skiing or puttering around museum galleries. Someone got land or a hands-off business centuries ago, and it’s supported the family ever since.

The odds of you buying up a small island or owning a Peruvian copper mine are small, but you can still purchase assets which greatly displace your cost of living expenses. For the price of a Patek Philippe Calatrava, or entry-level German car, you could easily buy a REIT or stock generating an additional $1,000 per year in cash payouts.

Suppose you get two big paydays (maybe a sales bonus or your eCommerce products hit a hot streak). You can do the standard activity and go out to buy a bunch of expensive things which depreciate in value (or require that you sell them to recoup any profit), or you can just stick that money into a cash generating asset. If you put $10,000 – $25,000 into a real estate trust or dividend stocks, you can have a free watch or vacation after 2 – 3 years of payouts. And, you’re still making money off your investments.

Final Thoughts

While I sometimes come across as pessimistic about Internet business or sales, I have a long-term positive outlook on most things. Having an online business is volatile, but it is a great way to branch out and create new opportunities for yourself.

That said, you do need to set aside some extra income if you want your money working for you.

There are a lot of people whose first good year of business is also their last, because they go out and spend 120% of their earnings, without thinking to the future. When crypto was big, a lot of people made tens of thousands of dollars recommending hot cheap alt coins on YouTube. A large number of them spent their ad money playing millionaire dress-up and I’d wager that many of them had to sell off their own Bitcoin during the market’s low-point just to pay the bills.

If you practice basic delayed gratification and don’t run out to buy expensive things the second your check arrives, you can build up your capital to the point where it pays for whatever you want. This is often easier than you’d think.

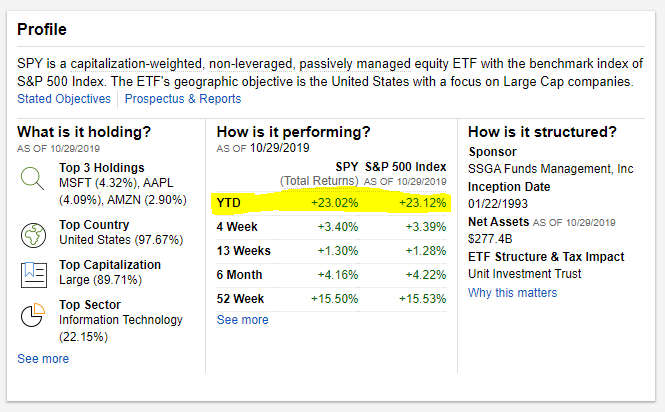

Basic example? If you invested in SPY (the largest, “safest” stock market investment around) back in January, you’d be up over 23%.

(A Very Boring “Bet” With Big Returns)

That’s pretty straightforward and easy. Bitcoin had huge fluctuations this year as well. I’m not a huge fan of crypto (compared to other assets), but if you were going to spend money anyway, you could have bought some at $4,000 – $5,000. And then sold for $9,000 – $10,000 later in the same year. There’s real estate too (commodity producing ground like farm or timberland is relatively cheap). And, you could always just buy a business outright. You could start a landscaping or tax preparation business for well under $10,000, source out the manual labor, and use your copywriting or marketing skills to aquire customers. That’s a lot less volatile than dropshipping or affiliate marketing.

The opportunity of a lifetime comes about once per year. But you need to be ready for it.