I’ve invested over $17,118 across the past four months, set aside some money for real estate, and went on two nice (but short) vacations this summer. That sounds impressive, but here’s the catch. I make a pretty modest amount of money.

Like well within the middle-class tax bracket.

In fact, many of my friends and family members make more than me. However, most of them spend their money on depreciating assets like cars, expensive booze, or watches. The result? They miss out on a great time period for building up multiple income streams and capitalizing on the power of compound interest.

Today’s article is all about seven things I personally avoid buying. And how doing so gives you a huge surplus in money you can reinvest into other ventures.

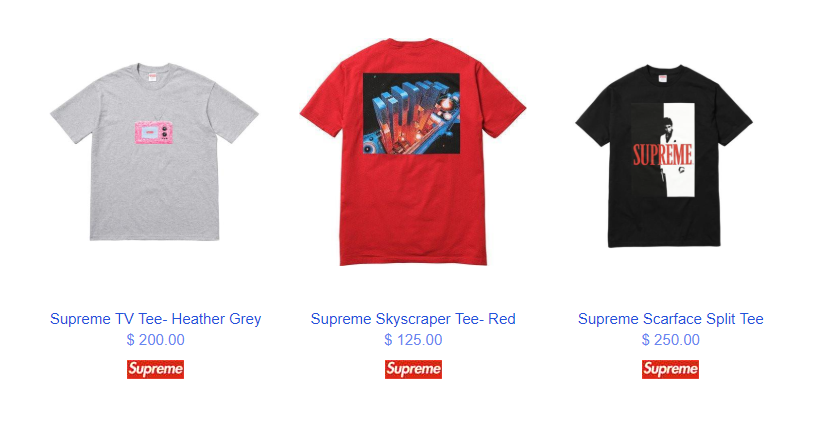

1. Meme Clothes

(These Are Wal-Mart Quality Shirts)

When I moved to Vietnam in 2015, I instantly went from spending $1,500 in rent to $500. Being 21, I took some of this money and made a sound investment in two expensive T-shirts.

I’ve probably worn them half a dozen times at most. And when I do, I’m always worried about spilling something on them, or getting sweaty armpits.

In contrast, I usually wear cheap, form-fitting, monochrome V-necks that cost $7 – $10 each. When I spill something on them or a muddy dog jumps on me at the park, oh well. They’re a workout shirt now. I’m not losing sleep over that.

In many cases, high-end clothes really don’t matter. Especially casual wear. Those Supreme T-shirts people spend $400 look terrible. And almost any outfit from Gucci makes you look like you’re cosplaying as the Paddington Bear.

Buying clothes that fit, and being in shape, is infinitely more important than what’s trendy.

A big fat guy in a Balmain outfit is still a big fat guy.

And how much you spend on clothes really doesn’t improve your physical attractiveness beyond a certain point.

2. Hipster Restaurants

Most trendy restaurants are basically junk food dressed up.

French fries cooked in duck fat, locally sourced pizza, gluten-free hamburger served on a thrice toasted artisan bun. Many of my friends love going to these places, but I honestly don’t get it.

Paying $30 for a burger and fries seems stupid to me. Especially when there are tons of wonderful, quality restaurants for about the same price.

Likewise, I suggest avoiding chain coffee shops (like Starbucks) for similar reasons. Nicer, more upscale tea and coffee houses cost about the same.

When I go on dates or meet friends for coffee, I usually go to a place like Harrod’s or some of the nicer independent tea houses around town. Despite being much better than a Starbucks type chain venue, the prices are generally the same.

If you’re going to overspend on tea or coffee, do it someplace nice.

3. Cars

What do Zuckerberg, Warren Buffett, and Jeff Bezos have in common?

They all drive modest cars. A lot of people, including many of my relatives, spend way too much leasing cars they can’t afford.

The most commonly leased luxury car in America is a Mercedes C-Class. And it costs about $1,000 a month to drive. That adds up quick. And it’s not even a particularly cool car. There are many better ways to spend $1,000 per month (remember, this is $12,000 per year, or 6% of your income if you’re making $200,000).

You can put it in stocks, stash it in your emergency fund, or use it towards saving for real estate.

Also, many people who lease cars physically cannot invest in anything. They’re too strapped for cash, having wasted it all on depreciating assets.

Lastly, leasing cars and “fake it ’till you make it” isn’t a particularly good business strategy. Both my Dad and Uncle drove used cars the whole time they built their businesses, and I don’t think that ever killed a sale. Likewise, the only Maybach owner I know doesn’t take his car outside of our neighborhood because it’s a magnet for trouble.

Just something to think about before visiting the car lot.

4. Alcohol And Cigarettes

Drinking and smoking are two of the dumbest activities.

They’re expensive, they prematurely age you, and they also cause all sorts of terrible health problems as you get older. Like the fedora, most guys can’t pull this off.

For every George Burns or Dean Martin, there’s a hundred men embarrassing themselves while drunk.

Same goes for smoking.

Outside certain countries, it’s stereotyped as low-class.

Lastly, I want to quickly mention bottle service or nightclubs. Specifically for picking up women. This is something I see a lot in my neighborhood, where people rent a Lamborghini or rack-up huge bills to “impress the ladies.”

At that point, you’re paying for sex. And you might as well book an escort agency’s pornstar menage for half the price.

5. Owning A Home To Live In

This one is somewhat controversial, so remember that this is my personal opinion. But, I do not think that buying a house before buying a rental property is smart. Many people are really into renovating their homes. And it becomes a very expensive hobby requiring lots of time and effort.

According to my Dad, who’s an architect and owned a construction company for years, most people renovate their homes because:

A) In-laws are coming and they want to show off to them.

B) A neighbor remodeled and now everyone else is scrambling to do so.

If you’re always rushing out for new counter-tops and cabinets, things get expensive fast. Like I said, this is my opinion, and a lot of people do love their homes.

However, from a financial standpoint, you’re probably better off owning a revenue producing property before settling into your own house.

6. Day Trading And Penny Stocks

(Penny Stocks Are Not Good Investments)

Nothing gets the teenage boys more excited than YouTube day trading.

In reality, this is a pretty easy way to lose money.

Something like 97% of day traders lose, giving you worse odds than most casino games.

Penny stocks are no better, and many “gurus” use them for nebulous pump and dump schemes.

Personally, I’d stay away from both.

7. Brand New Books

This last one might sound a little weird, but as someone who reads a lot I buy most of my books second-hand.

Between GoodWill and the library, it’s easy to pick up a whole year’s worth of books for under $50. Any extra titles you want are easily filled on through Amazon. This might sound weird or frugal, but it’s a great way to quickly build up basic knowledge on a subject, without spending much.

Case in point, I bought Market Wizards, The Intelligent Investor, The Little Book That Beats Markets, and Invest The Warren Buffett Way for $0.10 each.

These same books would cost over $60 in total if you bought them new on Amazon.

Same information, massive price difference.