My 2018 goal is to invest $50,000 in the stock market. Right now I’m a quarter of the way there.

Because of this, today’s article will examine a few key differences between passive-passive income (stocks, bonds, etc…) and active-passive income (building an SEO niche site, writing an eBook, and so forth).

Here we go.

What Does A $12,500 Investment Buy?

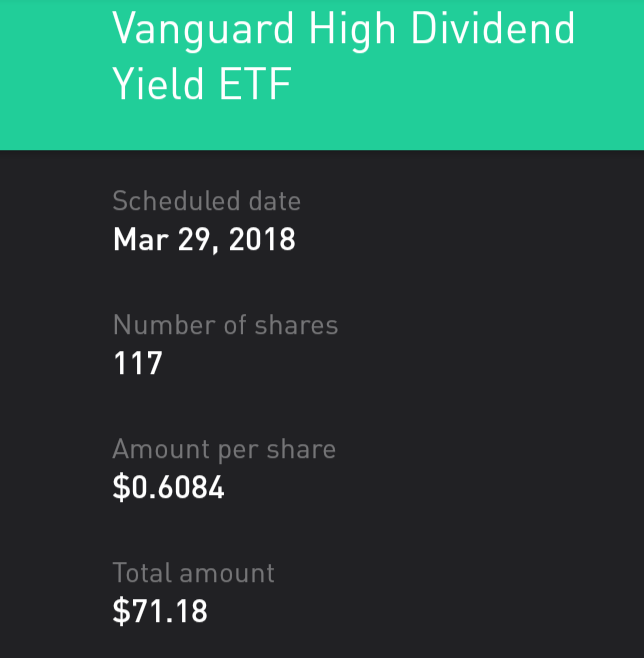

(VYM Quarterly Dividend Payment)

Unless you’re buying penny stocks, $10,000 or even $20,000 doesn’t net a whole lot. Investing in ETFs, I got 100+ shares of VYM and some SPY.

Those are long-term assets, their volatility is reasonably low.

Also, each one pays out a dividend.

So owning 100+ shares of VYM nets you about $300 per year in passive income (plus however much your assets grow).

SPY also pays out a dividend, and that one’s about $5 per year.

Really not a lot, unless you have a huge bankroll.

Investing’s biggest advantage is “The Snowball Effect.” Essentially the power of compound interest. Continually adding to your funds for years on end, and you eventually build a sizable return.

When you’re Warren Buffet and own a billion dollars worth of Kraft-Heinz, you’re seeing decent results.

However, it takes a lot of time and capital before you start gaining traction.

Which leads into the next section…

What Does A $25 Investment Buy?

$25 is not a lot of money. Most people will spend $25 bucks on lunch or impulse purchases and never think twice about it.

However, there’s a lot of small-scale investments you can easily make for under $25. Most of which offer higher returns than the average stock.

Here’s a quick list of 5 ideas to try (I’ve done them all):

1. Building An SEO Niche Site

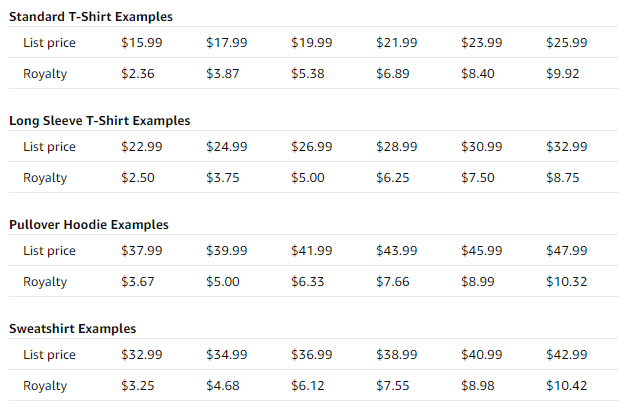

(Monthly Returns For One Site Outweigh $10,000 Worth Of Stock Dividends For An Entire YEAR)

I’ve written about this many time, but you really can’t get a better ROI than writing some Google-friendly sales letters.

There’s no “brand building” and you aren’t making lead magnets or trust-building content. Plus, there’s no product creation investment either (like writing an eBook or designing a course).

These are also pretty easy to whip up since you can always pick an already popular niche (i.e. dating sites and health supplements) or something that’s easy to sell on an emotional level (platform shoes for men, beauty cream for women).

You can also always just make a site based around something you already enjoy. I’ve got a couple sites in the BitCoin and gambling niches and they’re always fun to write.

Go read some books on copywriting and marketing (though don’t “drink the Kool-Aid” and become one of those people who join a bunch of mastermind groups and buy $1,000 sales training courses they’ll never use. Then practice daily.

[Big Hint: Go on Reddit or Medium and look at the most shared / read content in a niche like health, personal finance, dating, etc.. It’s a nice, vaguely motivational story (“How My Wife And I Paid Off $100,000 Worth Of Debt In Three Months”), with a broad appeal to a general unsophisticated audience (For years one of the top Reddit dating post was “How To Kiss A Girl”).

Charts, graphs, and lengthy technical descriptions (ironically the things I like writing) are better suited for Business-To-Business sales, which is a whole different ballpark.]

As far as traffic goes: Join a forum, make YouTube videos, open a Twitter account, sign-up for Reddit and Medium… You get the picture.

If traffic starts converting, scale up and then buy paid traffic.

2. Amazon Merch Store

Amazon Merch is a service which lets you upload T-shirt designs and sell them on Amazon.com. As far as passive income streams go, this one’s pretty low-risk. There’s not much cost or time investment, making it pretty easy to recoup your initial expenses.

I think I spent $20 buying a batch of funny shirt designs through Fiverr, and then just uploaded to Amazon.

The whole process took a whopping 10 minutes on my end. Yet the monthly sales continue trickling in.

At $3 – $5 bucks per sale, it’s not a huge earner. But the annual returns are about the same as having a few thousand dollars in the stock market (if you only sell $50 worth of shirts per month, you’re still making $600 a year in passive income).

3. Kindle eBooks

At one point, writing Kindle erotica was like having a license to print money. The “Unlimited” program worked like Netflix (but for books), allowing customers to read titles for free, while still paying the author $1.50 – $2.30 per copy borrowed.

You could quickly slap together a 3,000 word book, give it a graphic title (like “Anally Devastated By The Mailman While My Clueless Husband Is Watching Sports”) and generate $30 to $40 a day in Kindle Unlimited revenue.

Amazon eventually reworked their Kindle Unlimited program (since it hemorrhaged money), and eBook profits slumped.

That said, my Amazon royalty checks still come in every month, and they’re still pretty good.

When I did my taxes last year, I think my total Kindle earnings were over $5,000 for the USA, over $3,000 for the U.K., and another $1,000 – $2,000 for all the other marketplaces combined.

4. Betting On Sporting Events And Award Shows

Hollywood’s a very political place, making it easy to predict what their elites will (and won’t) like.

The King’s Speech, The Artist, and virtually any period piece about women or minorities is sure to do well during awards season.

Topical films also do well (as long as their controversial subject isn’t too fresh), and the material’s tamed down a bit.

Because of this, I was ecstatic when the Golden Globes’ money line wagers came out.

Both The Shape Of Water and Three Billboards had a positive return. Meaning you’d profit off flat betting either one.

I slapped $25 bucks on each and woke up to $100 (technically $75 since one of the $25 wagers did lose) in winnings.

Arguably the easiest 300% ROI in investment history.

If you’re knowledgeable about sports, politics, or film, it doesn’t hurt to bet on these.

Likewise, learning a game like poker or backgammon creates a nice little side income too.

Risky?

Sure. But so is every other investment on Earth.

With gambling at least you have a simple set of rules, and (in games like poker) some control over the outcome.

5. “Buying Low And Selling High”

Pardon the generic header, but this is a very simple strategy that works in many fields.

This could be anything from rare books to artwork, or even something more mundane.

On weekends, my brother usually goes to University clearance sales where schools sell all their old equipment (everything from filing cabinets to computers).

He usually buys chemistry stuff and then resells it on eBay.

When you buy a lot of items for $10 or $20, then sell each one for $30 (plus shipping and handling), you’re doing well.

Final Thoughts

While long-term investing is important, and certainly a better alternative to smooth-brain purchases like buying a watch or car, it won’t yield the insane gains that creating your own product or business will.

Will Freeman has a good article on this (link here) where he mentions that the top market wizards only net a 20% return on investment. And they’re the greatest in the game.

Likewise, this is tackled extensively in The Millionaire Fastlane. In that the author points out that most people pour all their personal resources into getting an annual 5% pay raise, then investing a thousand bucks a month into stocks. All so that in 50 years, they’ll enough passive income to survive on.

In reality, you’re better off setting up some sort of “money machine” for yourself. A web business, nontangable product (shirts, eBooks, or even something like Apps and software), or something with a decent margin that you can sell.

Once you’ve got money flowing in from these ventures, then go reinvest into stocks, index funds, or other assets.